Book Review: The Phoenix Project

Book Review:

The Phoenix Project: A Novel About IT, DevOps and Helping Your Business Win

By

Gene Kim, Kevin Behr and George Spafford

What the book is about:

The Phoenix project is a fictional novel about the importance, impact and use of Information Technology in a manufacturing organization. While its …

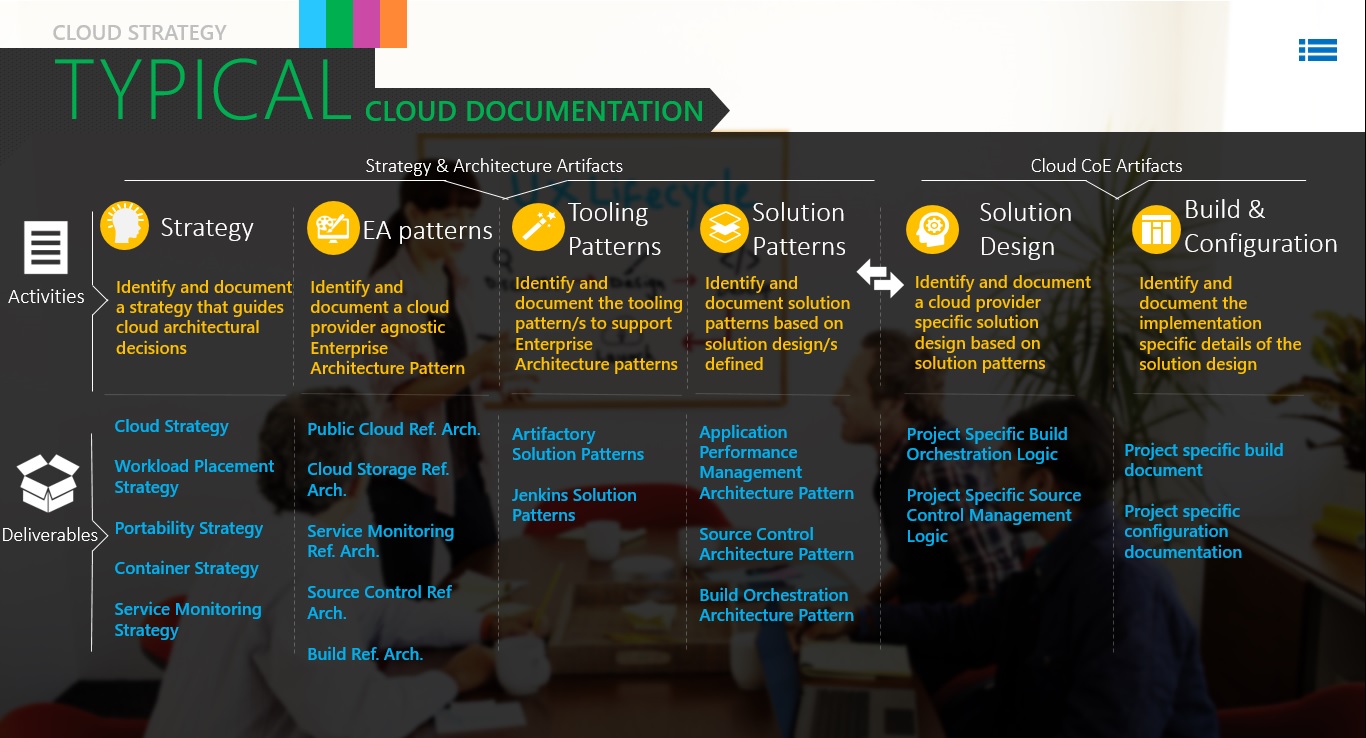

more ... As shown in the diagram above, the strategy …

As shown in the diagram above, the strategy …